24+ Biweekly loan calculator

This automatic calculator figures actual monthly loan repayments from a financial institution offering the entered terms. Learn More to Start Today.

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

With the biweekly program 12 of this amount will be debited every two weeks.

. Set the number of periods to 24. Traditionally mortgage payments are made every month. Supports missed and extra payments.

PMI is an added cost equivalent to 05 to 1 of your loan annually. 26 times per year. Biweekly Loan Calculator Loan Calculator With Extra Payments Savings.

The End Date will be February 16. Home Construction Loan Calculator excel to calculate the monthly payments for your new construction project. Has highly-competitive interest rates at 599 APR to 2899 APR for non-New York residents and 599.

The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. Removes PMI on a conventional loan. When any variable is changed the amortizing and interest-only payments will automatically update.

However there are only 12 months in the year and if you were making two payments each month you would only be making 24 payments a year. Enter an amount between 0 and 24. Student Loan Calculator is used to calculate monthly payments for your student loan.

This loan payoff calculator tracks payments on any date paid. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Generally the longer the loan term the greater the impact of rate fluctuations.

Enter the loan amount in the calculator if you know how much you will finance. The interest rate on this auto loan. This means that movements in interest rates can more deeply impact a 30-year loan than a loan with a 10 or 15-year term.

Enter the loan amount the loan term in years along with the stated interest rate eg. Citizens Pay Awarded Best Innovation from the 2022 Banking Tech Awards USA. Therefore if your monthly payment is 1500 a month you would.

Set Frequency to Monthly. The student loan amortization schedule excel will show you the principal interest remaining balance of each and every payment and is exportable as an excel spreadsheet. Borrowers should also understand the distinction between APR and.

A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This spells good news for your cash flow which allows you to set aside more savings. By default this calculator is selected for monthly payments and a 30-year loan term.

Ad Achievements for Solutions Services that define the future of Banking and Financing. A lower loan amount directly decreases your monthly mortgage payments. Fortunately with our auto loan calculator you can see how much your monthly payment will be how much interest youll pay and how much your loan will cost.

Principal Amount The total amount borrowed from the lender. The better it will be for your pocketbook in the long run. Bi-Weekly Mortgage Payment Calculator Terms Definitions.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. Some of Our Software Innovation Awards. Bi-weekly Payments for an Auto Loan Calculator.

Audit loans in progress. Some fees are not considered financing charges so you should check with your lending institution. Biweekly Payments save interest.

Bi-Weekly Payments Payments that occur once every two weeks. Though its eventually canceled its an added fee you can avoid by making a 20. Be sure to select the correct frequency for your payments to calculate the correct annual income.

This includes financing charges and any fees or additional costs associated with the loan such as closing costs or points. Mortgage Loan The charging of real property by a debtor to a creditor as security for a debt. Get More Out Of Your Home Equity Line Of Credit.

Biweekly vs Monthly Loan Calculator. This results in 26 payments a year instead of 24. This additional amount accelerates your loan payoff by going directly against your loans principal.

Since you would pay 26 biweekly payments by the end of a year you would have paid the equivalent of one extra monthly payment. 24 times per year. 52 times per year.

30-Year Fixed Mortgage Principal Loan Amount. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. Interest The percentage rate charged for borrowing money.

Loan Payoff Calculator wirregular payments. Whether you are building your own house or getting a loan for home improvement the home construction loan calculator will calculate the monthly loan payments with an amortization table and chart that is exportable to an excel spreadsheet. We calculate an accelerated biweekly payment for example by taking your normal monthly payment and dividing it by two.

Additionally borrowers should consider the duration of the loan. The amount of time youll have the loan. Since its founding in 2007 our website has been recognized by 10000s of other websites.

You can also use the calculator on top to estimate extra payments you make once a year. APR is the annual rate that is charged for a loan representing the actual yearly cost of a loan over the term of the loan. The second way is to make.

Please include your monthly prepayment amount. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources. A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan.

365 times per year. By making payments every other week you are actually paying an additional loan payment each year.

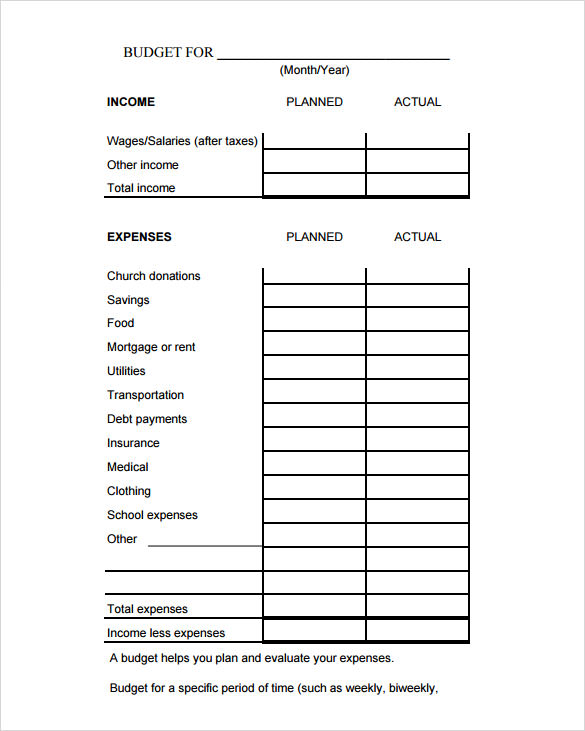

Free 9 Sample Budget Calculator Templates In Pdf Excel

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Annual Budget Template Debt Snowball Calculator Personal Finance Bundle Excel Debt Snowball Debt Snowball Spreadsheet Credit Card Debt Tracker

Biweekly Budget Biweekly Budget Excel Template Budget Spreadsheet Template Excel Budget Excel Budget Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Erie Insurance Review Auto Home And Life Insurance In 12 States

Paying Bills Bi Weekly Using A Budgeting Spreadsheet Budget Spreadsheet Paying Bills Budgeting

Pin On Useful Templates

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

23 Free Bi Weekly Budget Templates Ms Office Documents Weekly Budget Template Excel Budget Template Excel Budget

Here Are Five Tips To Help You End The Madness And Keep Current With Your Bi Weekly Pay Weekly Pay Monthly Bill

Mortgage Calculator

Monthly To Biweekly Loan Payment Calculator With Extra Payments Loan Mortgage Repayment Calculator Payment

Here Are Five Tips To Help You End The Madness And Keep Current With Your Bi Weekly Pay Weekly Pay Monthly Bill

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Printable Sinking Funds Saving Chart 1 Year Bi Weekly Etsy Savings Chart Sinking Funds Weekly Saving