29+ sales tax calculator modesto

Avalara provides supported pre-built integration. Web What is the sales tax rate in Modesto California.

9723 Gilded Cider Blvd Verona Wi 53593 Realtor Com

The California state sales tax rate is 725.

. The combined rate used in this calculator 7875 is. Web The current total local sales tax rate in Modesto CA is 7875. Web For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

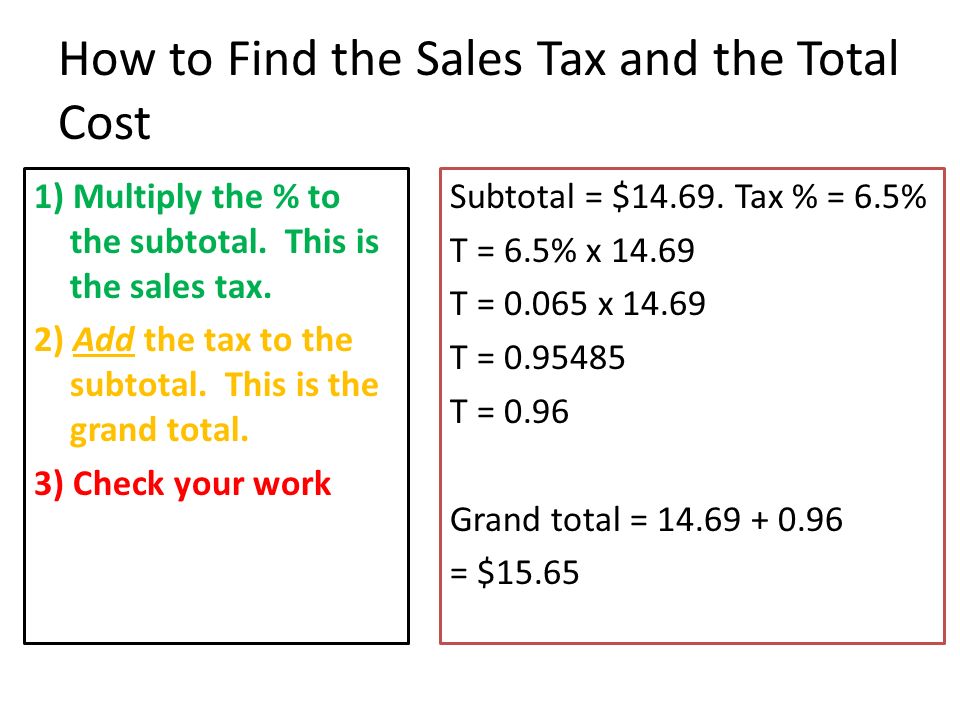

DID tax is calculated in the same manner as Mil tax except. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Look up the current sales and use tax rate by.

This is the total of state county and city sales tax. Local tax rates in California. 87 Of Customers Say QuickBooks Simplifies Their Business Finances.

The 95355 Modesto California general sales tax rate is 7875. Web The current total local sales tax rate in West Modesto CA is 7875. Web How 2023 Sales taxes are calculated for zip code 95355.

Web California sales tax details. Web Businesses in the downtown area of Modesto pay an additional tax to the Downtown Improvement District DID. Find out the net price of a product.

This encompasses the rates on the state county city. Sales Tax State Local Sales Tax on Food. Find out the sales tax rate.

The December 2020 total local sales tax rate was also 7875. Usually the vendor collects the sales tax from the consumer as the. The December 2020 total local sales tax rate was also 7875.

In our example let us make it 4. Real property tax on. The minimum combined 2022 sales tax rate for Modesto California is 788.

This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes. Web How to calculate sales tax with our online sales tax calculator. Web The base state sales tax rate in California is 6.

Web 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Web The 7875 sales tax rate in Modesto consists of 6 California state sales tax 025 Stanislaus County sales tax and 1625 Special tax. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Web The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A. The average cumulative sales tax rate in Modesto California is 798 with a range that spans from 788 to 838. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

There is no applicable city tax.

9 8 6th Grade Math Finding The Sales Tax Ppt Video Online Download

How To Calculate California Sales Tax 11 Steps With Pictures

Understanding California S Sales Tax

625 Burnt Sienna Dr Middleton Wi 53562 Realtor Com

Finding Sales Tax Youtube

26 Lamplighter Way Madison Wi 53714 Realtor Com

California Sales Tax Calculator And Local Rates 2021 Wise

W5597 Haynes Rd Pardeeville Wi 53954 Realtor Com

Mc Software Transformando Ideias Em Realidade

Sales Tax Calculator

California Sales Tax Calculator

W5597 Haynes Rd Pardeeville Wi 53954 Realtor Com

How To Calculate California Sales Tax 11 Steps With Pictures

1 125 Sales Tax Calculator Template

1213 Twisted Branch Way Sun Prairie Wi 53590 Realtor Com

5 Ways To Calculate Sales Tax Wikihow

Full Agenda Packet Contra Costa Lafco